Dear Customer,

When purchasing from our EU-based business, please be informed of the following points regarding potential tax and customs fees:

You can view the de Minimis thresholds for most common export countries here : https://www.avalara.com/us/en/learn/cross-border-resources/de-minimis-threshold-table.html

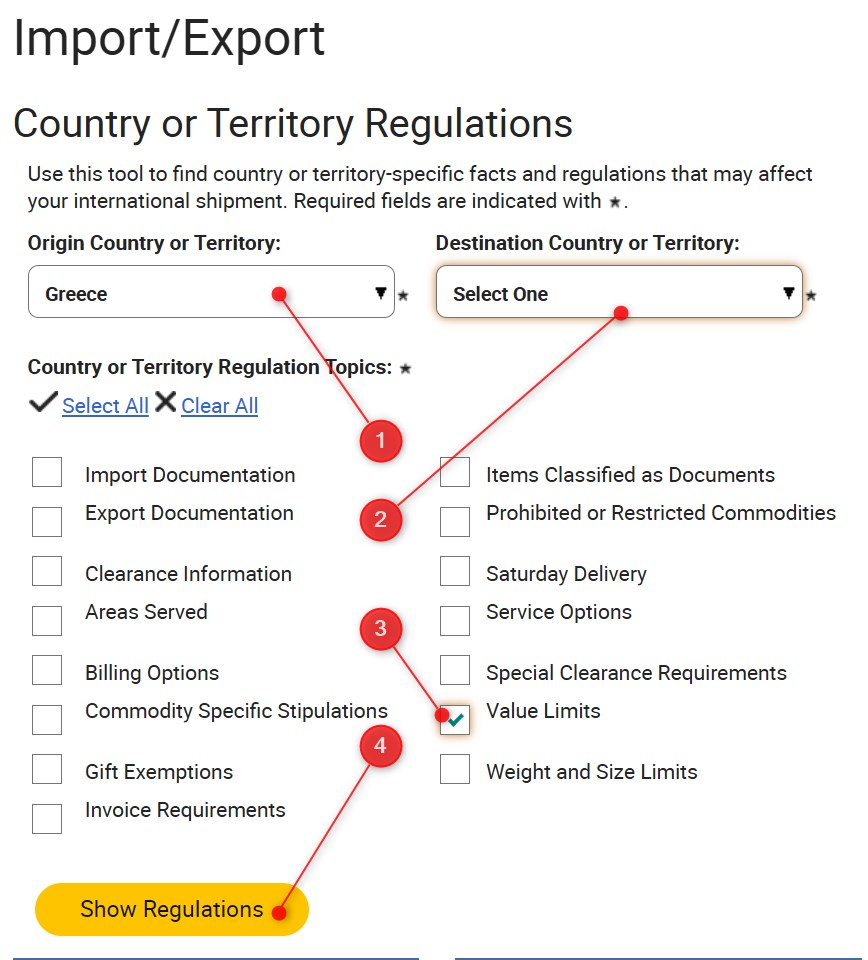

For more precise information , if you select UPS as the courier for your shipment, check the respective UPS page here: Import and Export Regulations | UPS – United States (setting Greece as the origin country (1), your country (2), check the value limits box (3) and click on show regulations (4)

If you have any questions or special requests, please don’t hesitate to reach out to our support team via the contact form accessible through the page footer links.

Starting August 29th, the U.S. government may apply import tariffs on certain lower-valued packages shipped to the United States. These tariffs, duties, or taxes are determined and imposed by U.S. customs authorities and are not included in the purchase price or shipping cost.

Please note that any such fees will be the responsibility of the customer upon delivery. We recommend reviewing your local customs regulations for more information.

Thank you for your attention to this matter